Q1 2022 Integrity Advocate

Celebrating 100% Participation in the Annual Code of Business Conduct Questionnaire and Certification Process

Each January, directors, officers, and employees are asked to certify that they’ve read the Code of Business Conduct (Code) and complete a questionnaire inquiring about compliance with company policies, including the Code and Conflicts of Interest Policy #2006.

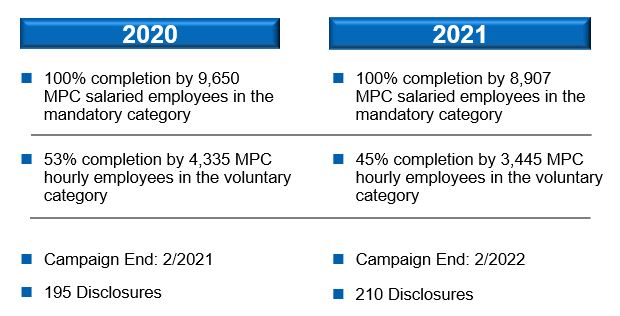

This questionnaire and certification process demonstrate MPC’s commitment to ethical business conduct and provide an additional opportunity for employees to disclose situations that may involve, or appear to involve, a conflict of interest or violation of our Code of Business Conduct. Below are this year’s campaign stats as compared to 2020.

Work is underway in Business Integrity and Compliance (BI&C) to review the 210 disclosures submitted by employees via the questionnaire. Those requiring further review will be referred to the appropriate organization, such as Human Resources, Internal Audit, and/or Health, Environment, Safety, Security & Product Quality. Submitting employees can expect to receive communication from BI&C acknowledging their submissions and providing direction, as warranted.

If a new conflict of interest arises at any time during the year, you may submit a disclosure via the Interim Disclosure process.

If you have a question or concern regarding the Code of Business Conduct or company policies, including a potential conflict of interest, you may contact the Integrity Helpline at FuelingIntegrity.com or 855-857-5700[1].

[1] Mexico - All Carriers 800.681.6945; Telmex 001 866 376 0139; Singapore – All Carriers 800.852.3912; Singapore Telecom 001 800 1777 9999

"The Accidental Email"

“The Accidental Email” is a fictional story that illustrates ethical choices related to reporting ethics violations. Each employee’s ethical choices play an important role in maintaining a company’s reputation for fair, honest business practices.

At the end of a long, chaotic week, Francine decided to check her emails before heading home. The upcoming week’s stockpile of messages would be massive enough without being added to what had accumulated while she’d been cooling her heels in a lengthy Friday afternoon staff meeting.

She scrolled through the unread messages. There were several informational emails from Raul, her manager, and some requests for status reports on a few ongoing projects. There were numerous messages on which she and several others in her department had been copied as a courtesy, and an email from her friend from another department, Lexi, inviting her to lunch next week. She also perused some updates from industry organizations to which she belonged. The usual stuff.

But then one email, in particular, caught her eye. It was from Megan Morehouse, the company’s finance VP. As she quickly skimmed the text, ready to delete the email, Francine realized two things. First, the message had been sent to her by mistake, intended instead for “the other” Francine, Francine DuChamp, who worked in Accounting. Second, it contained explicit instructions to that employee about how to cover up a major financial accounting error.

She read the email over again, hoping she’d misinterpreted it, but ending up convinced of—and horrified by—its intent. She wasn’t sure what to do, and she certainly wasn’t going to take action at the close of business on the eve of a weekend. However, she printed a hard copy of the email and then filed the email in her saved folder for safekeeping until she could figure out her next move.

On Monday, she went out for an off-site lunch at a nearby deli with Lexi. After they’d settled into a booth with their sandwiches, she decided to broach the topic.

The Dilemma

“What would you do?,” Francine asked, “if you knew that something was being done in the company that wasn’t entirely above board?”

“That depends,” said Lexi. “Are you the one who’s messing up?” She chuckled.

“Lexi, I’m serious,” said Francine. “And no, it’s not me, it’s this email I received by mistake from accounting.”

“Well, if it’s something that impacts our company financially, that could be huge,” Lexi said.

Francine looked thoughtful. “Maybe I should just forget about what I found out by accident.”

“I don’t know what you found out, exactly, but what I do know is it’s bothering you,” said Lexi, as she speared her pickle. ”You’ve got to report it, especially if it’s related to financial stuff.”

“Are you sure, you think I’m required to?” asked Francine.

I know how we can be sure,” said Lexi, picking her phone up from the table. “Let’s look it up in the Code of Business Conduct on the company’s website, they post it out there, it’s public.”

Francine picked at her lunch while Lexi scanned the Code. After a minute or two Lexi said, “So, it says under Getting Help on page 24 that if an employee becomes aware of any concerns respecting the financial integrity of the company, including questionable accounting or auditing matters, he or she must bring it to the attention of management or Business Integrity and Compliance.”

“How can I be sure they’ll follow up on it?” said Francine. “It seems like a pretty bad thing. I mean, heads might roll. Or even worse, the company might just look the other way.”

“In that same Getting Help section, it says all reports are taken seriously and will be investigated in a manner and to the extent appropriate based on its nature,” Lexi responded. “Besides, BI&C and management know the importance of accurate financial records and understand there’s stiff penalties–fines, imprisonment, loss of employment– when a public company cannot guarantee its records are current and accurate, especially if there’s any funny business. They can’t turn a blind eye.”

“Thanks,” said Francine. “I’ve got a call to make.”

Points to Consider

Imagine the fictitious story above happened at MPC and consider how you’d answer these questions:

1. Do you agree with Lexi that Francine is required to report the situation?

Yes. As with any other type of known or suspected misconduct, employees have an affirmative duty to report questionable accounting matters.

2. What if Francine is concerned about sharing her identity, can she really make an anonymous report if she chooses?

Yes, she can contact the company’s Integrity Helpline at FuelingIntegrity.com or (855) 857-5700[1] to make an anonymous report. Complaints or concerns regarding questionable Accounting Matters reported are kept confidential and information regarding such complaints, including the identity of the source of such complaints, will only be revealed when necessary to carry out the intent of the company’s Whistleblowing as to Accounting Matters policy or in such circumstances where the company is required by law to release such information.

3. How can Francine be sure her report is taken seriously?

Upon submitting a report through the Integrity Helpline, the reporting party will receive an access code and password to check the status of their report in Convercent, the system through which reported concerns are managed.

4. Is Francine at risk for being disciplined if she reports the situation?

No. Filing a good faith report will never be a cause for disciplinary action.

Reference Policies:

Policy #2004 – Whistleblowing as to Accounting Matters

Policy #2007 - Anti-Retaliation for Reporting Illegal or Unethical Conduct

Policy #2008 - Reporting of Illegal and Unethical Conduct

Code of Business Conduct

[1] Mexico - All Carriers 800.681.6945; Telmex 001 866 376 0139; Singapore – All Carriers 800.852.3912; Singapore Telecom 001 800 1777 9999

It Happened Here

The following scenarios happened with employees at our company. Situations and descriptions have been edited to maintain anonymity and confidentiality.

Click arrows below to view the company response to the concern.

The Concern: Employee was reported for being verbally aggressive with co-worker during shift.

The Response:

Investigation confirmed employee’s verbal mistreatment of co-worker. Employee received a formal coaching session; clear expectations for future behavior were set.

The Concern: Employees were reported to be sharing account login information with co-workers.

The Response:

Investigation confirmed employees had in fact shared login information with co-workers that did not have access to certain systems. As stated in Policy #6004 - Computer Security, all authorized users are responsible for safeguarding passwords and other sensitive access control information related to their own accounts or network access. Policy #6004 was reviewed with employees and employees were advised not to share passwords.

The Concern: Employee was reported for using inappropriate language with a vendor at the vendor's place of business.

The Response:

Investigation confirmed that the employee made inappropriate remarks, offsite, to a vendor. Policy #10003 - Harassment & Appropriate Workplace Conduct extends to work-related situations involving interaction between or among employees, vendors, contractors, and customers, which occur on or off company property or during or after regular work hours, including off-site meetings, business travel, and social events. Employee received a formal coaching session; clear expectations for future behavior were set.

Be an Integrity Advocate

Being an advocate is about speaking up not only about what may be wrong, but also about what is going right. Examples of ethical conduct should be highlighted and celebrated!

We invite you to help expand the scope of “It Happened Here” to include positive stories of integrity in action in future issues of the Integrity Advocate by submitting instances of integrity in action to Business Integrity and Compliance, Room M01004 Findlay Campus or [email protected].